Happy Monday with Dean and Crystal…

It is… another Monday in June, our Post-Father’s Day edition…and, it is that day of the week when we look at the behavior of the housing market, and leading indicators of market trends, both in the U.S. …and locally… for the past week.

We always like to offer some hors-d’oeuvres before we move on to the main course…Shall we get started with some appetizers and some ‘Tidbits‘?

Well, thanks for offering and I’d love some…

- Today is the first time the markets, banks, and other State and Federal offices close for Juneteenth, the new federal holiday celebrating the end of US slavery.

- On This Date, June 20, 1975… a film directed by Steven Spielberg that made countless viewers afraid to go into the water, opens in theaters.

- Cramped: As the US’s tampon shortage continues, tampon makers are ramping up production. Tampon prices have jumped 10% this year as supply issues strain manufacturers.

SNACK FACT of the DAY:

- YouTube’s TikTok knockoff, dubbed “Shorts,” has 1.5B+ monthly viewers

Are you…Ready… for the main course?

… Let’s look at the US Real Estate Market and how it performed last week:

What is slowing and what isn’t in the Market Shift…

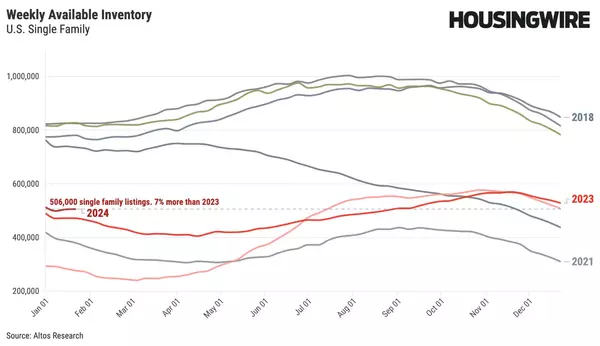

Available inventory of unsold single-family detached homes rose another 5.6% last week to 418,688 homes. we have 18% more homes on the market than last year at this time…by the end of June, we’ll have more homes than we did last year at the peak of the market in September ’21.

Inventory is growing for 3 reasons:

1. Insatiable buyer demand over the last two years is starting to be satiated.

2. Rising interest rates.

3. Falling financial markets

Many buyers are now priced out and they have to sit on the sidelines until something changes. On the supply side, higher interest rates mean fewer homes look good as investment properties. Also adding to the inventory is the phenomenon where buyers of step-up properties were holding on to their homes as rentals because the interest rates made it viable to cover the mortgage with rental incomes. Third on this list are the investors that are selling to raise capital, so as to weather what they perceive as a deep market correction.

Home prices, meanwhile, are still at their record highs and actually ticked up from the previous week to $454,000, which is still 13% higher than last year at this time.

The price of the new listings is unchanged this week at $425,000.

The REAL story of the summer is …Price Reductions…price cuts keep climbing and are up to 27.2% of the available inventory…remember that, in a normal market, about 33.3% of the inventory adjusts their price before going under contract, so we’re observing a much more rapid increase in this indicator than was projected. For sellers… This is the proverbial ‘curve’ and it’s most important to price ahead of the curve rather than behind it…

Immediate Sales were down last week, and only 22.7% of the new listings went under contract…down from 1/3 of the market from just a few months ago.

Here is another leading indicator that we haven’t mentioned for quite a long time…Percent of Active Re-Listed homes…these are homes that were active and, on the market, and for some reason, either canceled, withdrew, expired, or their realtor took it off the market to re-set the days on market. Last week, 1.6% of the active listings were ‘re-lists‘…

In Summary…

What the Future Indicates for Buyers

Over the past six months, interest rates have been steadily increasing. While rates averaged around 3.05% towards the end of 2021, they have since increased to an average of 5.10% as of May. Even though there are still a high number of potential buyers on the market, the higher interest rates have allowed the market to stabilize somewhat.

While home prices may have been lower one year ago, the increased buyer competition in the market made it difficult for many buyers to make bids that were high enough to satisfy the seller. Once demand decreases among buyers, home inventory will increase, which means that you may find it easier to purchase a home without needing to make an offer that’s far higher than the listing price.

In general, you should expect demand to still be relatively high and housing inventory to be relatively low. However, both of these metrics have improved in recent months, which means that the market shouldn’t be as intense as it was in 2021. Home prices are also expected to rise this year but shouldn’t come close to the 20% increase that occurred last year.

What the Future Indicates for Sellers

If you’re looking to sell your home but worry that the market may not be favorable for doing so, the truth is that the housing market still favors sellers. The main difference is that there may not be a lengthy bidding war when you list your home on the market. However, sellers still hold ample amounts of negotiating power when an offer is made. If you want to make sure that your home is sold without delay, perform any necessary upgrades and repairs before placing your home on the market.

While it’s unlikely that the housing market will shift completely to favor buyers, it’s looking increasingly likely that the market will be more balanced over the next year or so. A balanced and healthy market is great for buyers and sellers alike

Okay, friends… it’s time to get local…and here is what happened in our Local Markets last week:

Castro Valley: This week the median list price for Castro Valley, CA is $1,299,000 with the market action index hovering around 78. This is less than last month’s market action index of 80. Inventory has increased to 53. Median days on market is 7 while average days on market is 30.

The market has been cooling off consistently for several weeks, as more homes are available and demand is less. We have begun to see prices move lower as a result. If the MAI falls into the Buyer’s zone, it is likely that prices will continue their downward trend until we see some turnaround in Market Action.

San Lorenzo: This week the median list price for San Lorenzo, CA is $ 848,000 with the market action index hovering around 91. This is about the same as last month’s market action index of 91. Inventory has increased to 19.

Median days on the market is 7 while the average days on the market is 10.

The market has been cooling over time and prices plateaued for a while. Despite the consistent decrease in MAI, we’re in the Seller’s zone. Watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

San Leandro: This week the median list price for San Leandro, CA is $ 976,999 with the market action index hovering around 81.

This is less than last month’s market action index of 85. Inventory has increased to 52. Median days on the market is 14 while the average days on the market is 23.

The market has been cooling over time and prices plateaued for a while. Despite the consistent decrease in MAI, we’re in the Seller’s

zone. Watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Hayward: This week the median list price for Hayward, CA is $ $931,500 with the market action index hovering around 82. This is less than last month’s market action index of 89. Inventory has increased to 98. Median days on the market is 14 while the average days on the market is 24.

The market has been cooling over time and prices have recently flattened. Despite the consistent decrease in Market Action Index, we’re in a Seller’s Market (where significant demand leaves little inventory available. If the MAI begins to climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Union City: This week the median list price for Union City, CA is $1,398,888 with the market action index hovering around 66. This is less than last month’s market action index of 80. Inventory has increased to 51. Median days on market is 14 while the average days on the market is 22.

The market has been cooling over time and prices plateaued for a while. Despite the consistent decrease in MAI, we’re in the Seller’s zone. Watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI

drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Danville: This week the median list price for Danville, CA is $ 2,599,000 with the market action index hovering around 80. This is less than last month’s market action index of 88. Inventory has increased to 85. The median days on market is at 14 and the average days on market is at 36. The market has been cooling off a bit in recent weeks, as more homes are available and demand is less. We’re already seeing prices move lower as a result. Expect this trend to continue, especially if the index falls to the Buyer’s zone. Watch for a persistent up-turn in Market Action to signal prices rising again.

Pleasanton: This week the median list price for Pleasanton, CA is $1,799,000 with the market action index hovering around 82. This is less than last month’s market action index of 92. Inventory has increased to 81. The median days on the market is 14 while the average days on market is 15.

The market has been cooling over time and prices plateaued for a while. Despite the consistent decrease in MAI, we’re in the Seller’s

zone. Watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Livermore: This week the median list price for Livermore, CA is $1,325,000 with the market action index hovering around 87. This is less than last month’s market action index of 98. Inventory has increased to 120. The median days on the market is 14 while the average days on the market is 25.

The market has been cooling over time and prices plateaued for a while. Despite the consistent decrease in MAI, we’re in the Seller’s zone. Watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Tracy: This week the median list price for Tracy, CA is $825,000 with the market action index hovering around 79. This is less than last month’s market action index of 89. Inventory has increased to 129. The median days on the market is 14 while the average days on market is 24.

The market has been cooling over time and prices have recently flattened. Despite the consistent decrease in the Market Action Index

(MAI), we’re in a Seller’s Market (where significant demand leaves little inventory available). If the MAI begins to climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Mountain House: This week the median list price for Mountain House, CA is $1,049,499 with the market action index hovering around 73. This is less than last month’s market action index of 82. Inventory has increased to 55. The median days on market is 21 while the average days on market is 28.

The market has been cooling over time and prices have recently flattened. Despite the consistent decrease in (MAI), we’re in a Seller’s Market (where significant demand leaves little inventory available). If the MAI begins to climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

As your Real Estate Market Experts, Crystal and I work hard to study the market and bring a deep understanding of the market’s complexities, a lengthy list of qualified buyers, and access to off-market opportunities, to you…and… at the precise time that you need it.

It’s important for you as a homeowner or a home buyer to have the most current information and understanding of the market at that moment.

Crystal and I take great care to study the market to be able to translate what it means and how it affects your real estate decisions.

This is our job, our passion and we’re excited to share it with you, whether it’s a question you have or for an upcoming decision.

We are here to help…

Let’s talk before you make any decisions.

Until next week…stay safe… and happy trails to you…

Warmly , Dean Souza

Dean & Crystal Souza

Realtor | Broker Associate

Century 21 RE Alliance – Souza Team

homes@souzateam.com

510-881-1761

DRE 00967442 | 01448392

Focused on the Success of Your Move

This is not intended to solicit properties or persons under contract.

GET MORE INFORMATION