Happy Monday with Dean and Crystal…

Monday Market Matters

With The Souza Team Century 21 Real Estate Alliance

Weekly Digestible Real Estate Market Updates

It is… another Monday, the post-Easter edition….and it is that day of the week where we look at the behavior of the housing market, leading indicators of market trends, both in the U.S. …and locally.

How was your Easter weekend? Shall we get started with some appetizers and some ‘Tidbit’s…or leftover Easter eggs?…

– Crypto in the capitol(s)… While the federal government debates how to regulate cryptocurrencies, lobbyists are taking a state-by-state approach. this year 150+ crypto-related bills have been proposed in 40 states.

– OT: Lawmakers in California are considering cutting the workweek to 32 hours for companies with 500+ employees. Longshot?

– Runs in Family? It must run in the family: a year after the container ship Ever Given got itself wedged in the Suez Canal, its sister ship, Ever Forward, is now stuck in the Chesapeake Bay. Tune in to the sequel in the same place you watched the original: IsTheShipStillStuck.com.

– SNACK FACT of the DAY: There are 170K ways to customize a Starbucks drink order

Ready… for the main course?

– Let’s look at the US Real Estate Market and how it performed last week:

How High Will Home Prices Climb this Year?

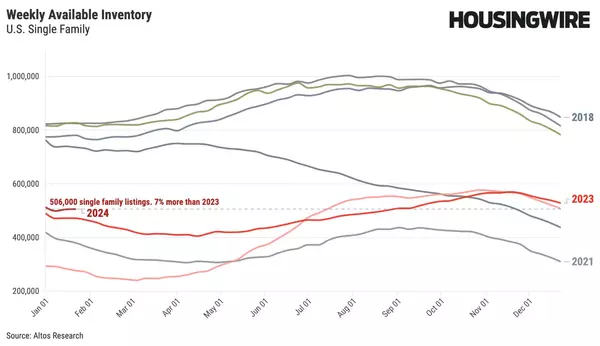

Available inventory of unsold single-family homes continues to rise and was up 3.6% to 271,000 single-family homes last week.

This is quite common for this time of year and even though inventory is rising faster than last year at this time, we still have fewer available properties…and more competition among buyers.

If inventory gains start to accelerate over typical seasonal patterns, by July, we could at that time where we could see some healthy gains in inventory.

Prices have continued their rise and nationally, hit a new record-high with the median price at $419,900 last week. That is a 1% rise week over week and staying at a 10-12% increase in price over last year.

Much of what is driving the rise in prices is the imbalance between supply and demand. Illustrating this are the number of Immediate Sales which came in at 31,400. Last week, we reported that this number shrank a bit, however it rebounded and accounted for 34% of last week’s sales of the 91,995 newly listed properties. This data is still telling us that there is no slowdown of buyer demand currently.

In summary:

Despite rising interest rates, buyers are still buying, prices are still rising… like we would expect during the spring sales season, and even IF a recession is coming, that in itself doesn’t foretell home price decline.

And again…we will report back next week…so, now Let’s Get Local…and track the markets where a lot of live…

Castro Valley: This week the median list price for Castro Valley, CA is $1,725,000 with the market action index hovering around 88. This is an increase over last month’s market action index of 86. Inventory has increased to 27. Median days on market is up to 7 this week and average days on market is at 34. The market continues to get hotter. More sales demand and fewer homes listed have contributed to a relatively long run of increasing prices

San Lorenzo: This week the median list price for San Lorenzo, CA is $813,944 with the market action index hovering around 93. This is less than last month’s market action index of 94. Inventory has increased to 8. Median days on market is at 4 this week and the average days on market is 7, both an increase over last week. In the last few weeks, the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

San Leandro: This week the median list price for San Leandro, CA is $912,000 with the market action index hovering around 88. This is less than last month’s market action index of 90. Inventory has increased to 30. Median days on market is at 7 and average days on market is also at 7. The market has been cooling over time and prices plateaued for a while. Despite the consistent decrease in MAI, we’re in the Seller’s zone. Watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Hayward: This week the median list price for Hayward, CA is $968,944 with the market action index hovering around 92. This is less than last month’s market action index of 94. Inventory has increased to 56. Median days on market is at 7 and average days on market is at 27. In the last few weeks, the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

Union City: This week the median list price for Union City, CA is $1,275,000 with the market action index hovering around 87. This is an increase over last month’s market action index of 77. Inventory has increased to 17. Median days on market is at 0 and the average days on market is at 14. While the Market Action Index shows some strengthening in the last few weeks, prices have not seemed to move from their plateau. Should the upward trend in sales relative to inventory continue, expect prices to resume an upward climb in tandem with the MAI.

Danville: This week the median list price for Danville, CA 94526 is $2,895,000 with the market action index hovering around 99. This is an increase over last month’s market action index of 89. Inventory has decreased to 12. Median days on market is at 4 while average days on market is at 28 this week. Home sales continue to outstrip supply and the Market Action Index has been moving higher for several weeks. This is a Seller’s market so watch for upward pricing pressure in the near future if the trend continues.

As your Real Estate Market Experts, Crystal and I have a deep understanding of the market’s complexities, a lengthy list of qualified buyers, and access to off-market opportunities. If you or someone you know is looking to buy, sell, or invest, contact us today!

We enjoy your comments and continued readership and I’ll sign off again with…

Happy Trails and until next week, be safe and healthy.

Warmly , Dean Souza

Dean & Crystal Souza

Realtor | Broker Associate

Century 21 RE Alliance – Souza Team

homes@souzateam.com

510-881-1761

DRE 00967442 | 01448392

Focused on the Success of Your Move

This is not intended to solicit properties or persons under contract.

GET MORE INFORMATION